Our Q1-2017 New York Residential Solar Study is Available For Download.

Solar is a complicated decision and Sunvago has compiled this guide to New York solar with the cost of solar panels in New York and advice on how to estimate cost and savings, navigate state and federal incentives, and find the best solar companies in New York.

New York Solar: Solar Savings and Costs

The sections below provide more information on how to find the right solar contractor and system, but please use these price guidelines to ensure you do not overpay for solar.

Average Cost of Solar Panels in New York

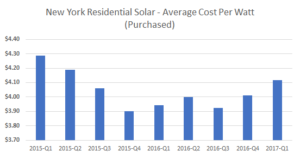

Before tax incentives, the average cost of solar panels in New York was $4.11 in Q1-17, which is a 5% decrease from $4.30 in Q1-15. This is largely due to module price declines (as much as 30%), as noted by an article from Reuters on Sunpower, the second largest U.S. panel maker. The average residential system was 7.74 kWh for an average cost of $31,830 before incentives.

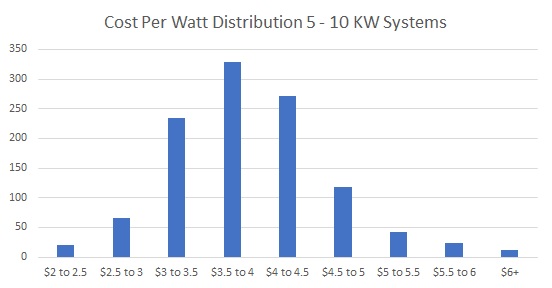

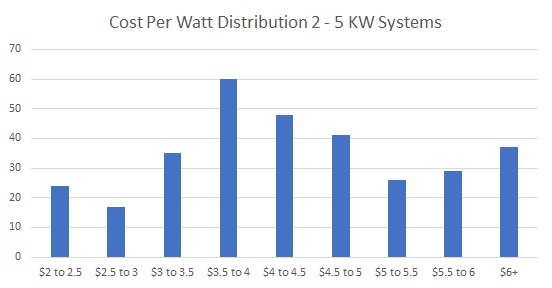

Cost of Solar in New York – Pricing Distribution (Last Update: Q4 2016)

It is helpful to look at averages, but the best way to make sure you are not overpaying for solar is to look at a pricing curve. The price curve below is for host-owned systems (not leases) in Q4 of 2016 for larger and smaller systems. There are many variables that go into the cost of the system, including the quality of the equipment you choose, but it is clear from the data below that an acceptable range for the cost of solar panels in New York is between $3.00 and $4.50.

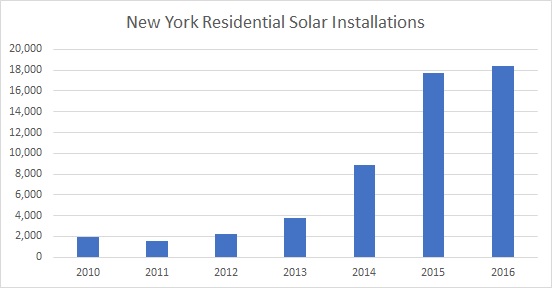

Solar trends in New York

Residential solar installations have increased significantly in New York, although growth slowed in 2016. From 2010 to 2016, installations have increased by ~45% a year to over 18,000 in 2016, making New York the second largest residential solar market in the U.S. behind California. If you are interested in more specific trends, please read our research recap on the 2016 solar market in New York. Many New Yorkers are switching to solar because of the decrease in price and high costs of electricity in New York. According to the EIA, retail electricity costs in New York are $16.25 per kWh vs. $10.44 for the U.S., or nearly 60% greater.

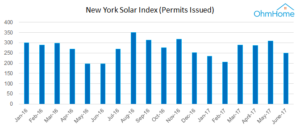

Solar Trends in New York: June 2017 Update

New York solar permits increased 26% to 249 in June from 197 in June 2016 and decreased 19% from May 2017 (YTD increase of 2%)

New York Solar: Solar Incentives

New York has some of the most attractive solar incentives in the country, which can reduce the a solar system by as much as 50%. In addition to the New York state incentive, there is the 30% federal tax credit.

New York State Incentives

Here is what you need to know regarding New York tax incentives:

- The Megawatt Block Incentive Structure – The Megawatt Block Incentive is a state incentive that is based on the size and territory of your system (measured in watts). The state is broken up into three regions (Long Island, Con Edison, and Upstate) and each region has a per watt incentive that decreases as more solar is installed within that region (installations are measured in blocks). The state provides the structure of each block here and the current status of the blocks here. Solar companies will include the Megawatt Block Incentive in their quotes and handle the processing for you.

- Net Metering – Any power in excess of your monthly use will accrue in a “power credit bank” that can be applied to months when your system is not producing excess power (winter or rainy months).

- New York State’s Solar Equipment Tax Credit – New York also offers a Solar Energy System Equipment Credit that lowers the cost of solar panels in New York. The credit is equal to the lesser of 25% or your system cost or $5,000 and can be claimed if you do a lease/PPA or purchase your system. As with other tax credits, the Solar Energy System Equipment Credit is a dollar for dollar reduction in your tax liability vs. a line item deduction. An added benefit is that you can roll the credit forward for up to five years. The New York State Department of Taxation and Finance has more specifics.

Federal Solar Tax Incentives

The IRS offers a 30% tax credit for solar systems based on the cost after state rebates and credits (discussed above). It is important to note that that federal tax credit only applies to purchased systems and you need sufficient tax liability to claim the credit. The federal solar tax credit was set to expire in 2016, but was recently extended through 2019, at which point it will start to decrease to 10% by 2022. The IRS form 5695, Residential Energy Credits can be found here.

New York Solar: Best Solar Companies

Solar is a complicated decision and the best way to ensure you are satisfied with your system is to find an honest and reputable solar company. We recommend reading our checklist before selecting a solar company. We have researched the top companies in New York and graded them on popularity (# of installations), pricing and customer reviews (a combination of multiple review sites).

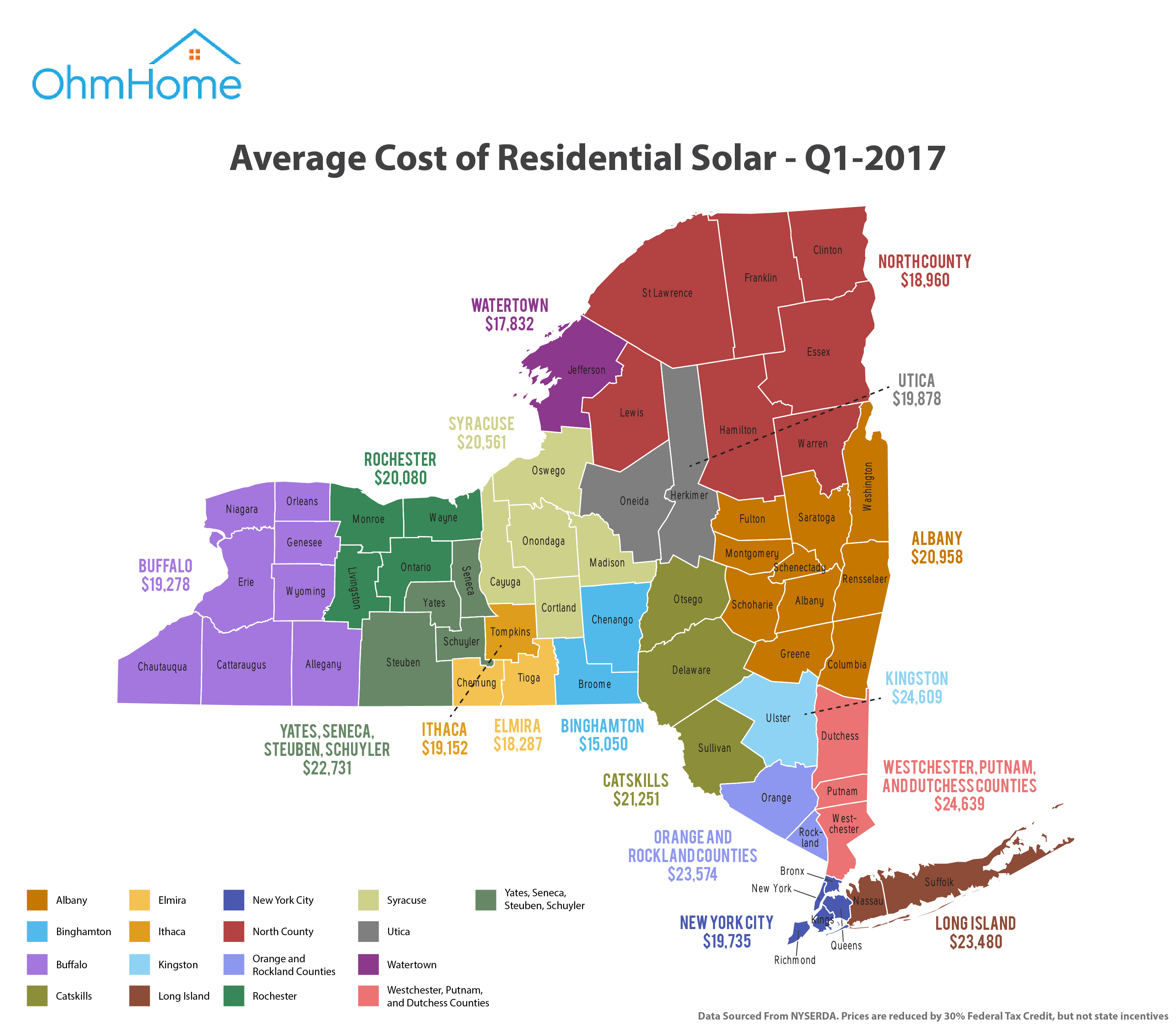

Our New York Solar Regional Guides

-

Solar in Albany

-

Solar in Binghamton

-

Solar in Buffalo

-

Solar in Catskills

-

Solar in Elmira

-

Solar in Ithaca

-

Solar in Kingston

-

Solar in Long Island

-

Solar in New York City

-

Solar in North County

-

Solar in Orange and Rockland Counties

-

Solar in Rochester

-

Solar in Syracuse

-

Solar in Utica

-

Solar in Watertown

-

Solar in Westchester, Putnam, and Dutchess Counties

-

Solar in Yates, Seneca, Steuben, Schuyler Counties