It has been a tough year for rooftop solar. The Solar Foundation released its jobs report for 2017 that showed an overall decline of 14%, although growth rates varied widely state by state. In addition, there is the looming threat of the solar tariffs and Tesla, the market leader in 2016, cut back significantly on acquisition spend in 2017, which impacted the entire industry. Despite all of the headwinds, Ohm Analytics’ Q4-17 commercial and residential solar report showed several positive trends (part of Ohm Analytics research).

Return to Consistent Growth

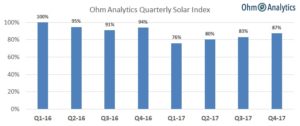

After a steep drop off in Q1-17, which was primarily driven by Tesla’s sales strategy change, the market has increased sequentially every quarter through Q4-17. Although activity was down -14% for the full year vs. 2016, the year over year decrease slowed to -7% in Q4-17 and Q4-17 represented 5% growth from Q3-17. The growth is primarily driven by developing states (FL, UT, TX, and NV), although the California market has recovered as well.

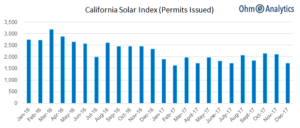

California, the largest U.S. solar market by a wide margin, decreased 27% for the year, but has seen consistent sequential growth, including 6% in Q4-17 vs. Q3-17. California was impacted by the pull-back by Tesla as well as a change in net metering policies in its major utility territories that have a slight impact on the economic value proposition for homeowners. We expect that the market recovery was due in part to (1) sales teams and homeowners getting used to net metering 2.0 and (2) a settling of installer landscape as sales teams moved from Tesla (and several large installers that went out of business) to other companies or started new ones.

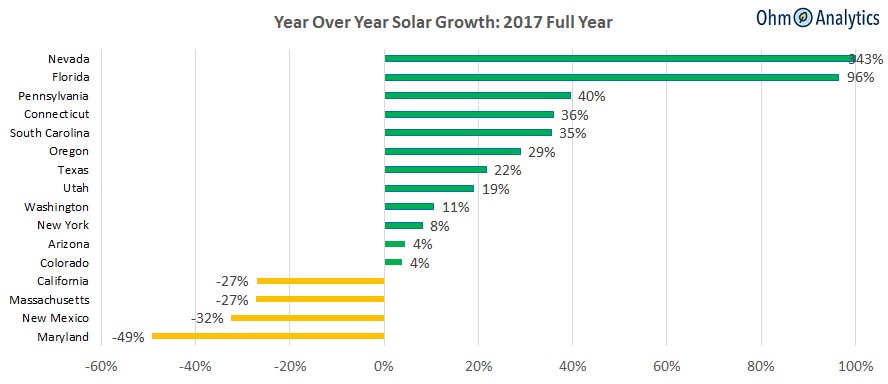

Developing Market Growth

The market recovery has also been driven by several rapidly-growing new markets, including FL, TX, PA, and UT.

In addition, following a reversal of the net metering policies in Nevada, the Nevada market has started to recover. Prior to the change in 2015, Nevada was a top 5 solar state so should move the needle for installers in 2018.